Logistics Partner Checklist for E-Commerce Brands: 25 Questions to Ask Before You Sign

The warning signs usually show up after you sign. The first invoice has surprise line items for extra touches you did not know existed. Orders start missing cut-off, tracking feels unclear, and your support team spends the day answering WISMO. Returns pile up, refunds slow down, reviews take the hit. Then peak season arrives and everything breaks at once, late dispatch, stock mismatches, tracking gaps, and a partner who suddenly cannot scale.

This checklist is built to stop that. These 25 questions help you expose pricing traps, tech and integration gaps, weak SLAs, and capacity limits before they become expensive. Use it on sales calls, in RFPs, and when comparing providers so you can shortlist with confidence and avoid switching again in six months.

Section 1, Fit and proven experience

1) What product categories do you specialise in, and which do you avoid?

- Why it matters: category fit affects damage, errors, and how many special cases become billable touches.

- Strong answer sounds like: they name categories they handle most, explain handling rules, and clearly state what they do not take.

- Red flag: they claim they can do everything but cannot explain category-specific processes.

- Follow-up: What are the top three handling risks for my products, and how do you control them?

2) Can you share 2 to 3 relevant case studies with similar SKU count and daily order volume?

- Why it matters: what works at 100 orders/day can break at 600.

- Strong answer sounds like: real numbers, what improved, and what the client had to change internally.

- Red flag: generic testimonials only, no comparable examples.

- Follow-up: What broke first when that client scaled, and how did you fix it?

3) What is your picking and shipping error rate for brands like mine, and how do you measure it?

- Why it matters: if accuracy is not measured clearly, you cannot manage refunds, reviews, or chargebacks.

- Strong answer sounds like: they define what counts as an error, show how they track it, and share a target range.

- Red flag: they do not track it, or they avoid sharing it.

- Follow-up: Show last month’s accuracy report and top reasons for misses.

4) Can I speak to 1 or 2 current customers as references?

- Why it matters: references reveal billing surprises and what support looks like under pressure.

- Strong answer sounds like: references with similar complexity and volume.

- Red flag: they avoid references or only offer unrelated ones.

- Follow-up: One recent onboarding reference and one long-term customer.

- Section example answer: We specialise in cosmetics and supplements, we avoid oversized freight. Here are two brands at 400 to 900 orders/day, plus monthly accuracy and returns metrics.

- Section red flag to watch: any provider that cannot show accuracy reporting.

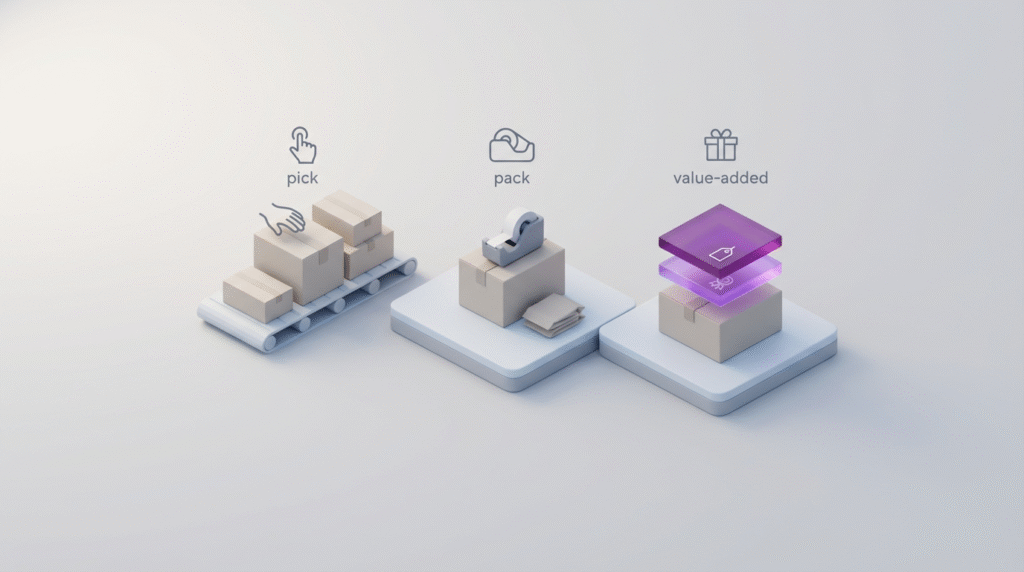

Section 2, Services and value-added capabilities

5) What is included in standard pick and pack, and what counts as an extra touch?

- Why it matters: extra touches are where the bill grows quietly.

- Strong answer sounds like: clear included list plus a clear extra-fee list.

- Red flag: vague language, or refusal to share details.

- Follow-up: Price my typical order in writing, then price three common variations.

6) Do you support kitting, bundles, inserts, and custom packaging workflows?

- Why it matters: these workflows drive AOV and promotions, but can get priced as manual labour.

- Strong answer sounds like: how kits are built, stored, quality-checked, and priced.

- Red flag: yes with no workflow details.

- Follow-up: What happens if a kit component runs out mid-day?

7) How do you handle fragile, bulky, or high-value items, including packaging rules?

- Why it matters: damage creates returns, reships, and negative reviews.

- Strong answer sounds like: packing standards, training, and SKU-level packaging rules.

- Red flag: no standards, or packaging risk pushed fully onto you.

- Follow-up: What is your damage reporting and claims timeline?

8) Can you support multi-channel fulfilment, including DTC, marketplaces, and B2B or wholesale?

- Why it matters: channels have different paperwork, label rules, and service expectations.

- Strong answer sounds like: separate workflows and SLAs by channel.

- Red flag: all orders handled the same way.

- Follow-up: How do you prioritise DTC vs marketplace orders during peak?

- Section example answer: Standard pick and pack includes one pick, one pack, standard dunnage, and label printing. Extra touches include kitting, inserts, relabeling, and special packaging.

- Section red flag to watch: any provider that cannot clearly explain what triggers extra-touch fees.

Section 3, Scalability and capacity

9) What are your minimums, practical maximum capacity, and how do you handle spikes?

- Why it matters: capacity without a surge plan usually means late dispatch when it matters most.

- Strong answer sounds like: real numbers, past peak volumes, and how staffing protects cut-off.

- Red flag: unlimited capacity claims or no numbers.

- Follow-up: What service levels changed for clients during the last peak?

10) What does peak season planning look like, and when do we lock forecasts?

- Why it matters: peak season failures are usually planning failures.

- Strong answer sounds like: a timeline, a forecast process, and agreed lock dates.

- Red flag: no formal peak plan.

- Follow-up: How do you allocate labour and carrier capacity across clients?

11) Do you have multi-warehouse options if we need distributed inventory later?

- Why it matters: faster delivery is possible, but only with strong inventory visibility and transfer rules.

- Strong answer sounds like: clear rules for splitting inventory, transfers, and order routing.

- Red flag: they say yes but cannot explain cross-site visibility.

- Follow-up: How do you prevent stockouts or duplicate allocations across sites?

- Section example answer: Peak planning starts 8 weeks before, we lock forecasts 3 weeks before, we add shifts and temp labour, and we protect cut-off for priority clients with agreed rules.

- Section red flag to watch: we will figure it out when we get there.

Section 4, Technology, integrations, and tracking visibility

12) Which platforms do you integrate with, and what is truly native vs custom?

- Why it matters: custom integrations can drag on and create ownership confusion.

- Strong answer sounds like: native connectors list, what is custom, and typical onboarding timeline.

- Red flag: no documentation, no timeline, no clear owner.

- Follow-up: Show your onboarding plan for my platform and who does what.

13) Do you support APIs or webhooks, and real-time inventory visibility?

- Why it matters: slow stock updates cause oversells, cancellations, and support load.

- Strong answer sounds like: near real-time updates, clear event types, export options.

- Red flag: inventory updates only once per day, or no API access.

- Follow-up: How are manual stock adjustments tracked and synced?

14) How does real-time tracking work, and which tracking events are exposed to customers?

- Why it matters: tracking reduces WISMO only when customers see clear milestones and believable ETAs.

- Strong answer sounds like: milestone list, ETA approach, proactive notifications, and a sample customer view.

- Red flag: vague statuses, long scan gaps, no proactive updates.

- Follow-up: Show a sample tracking page and your customer message templates.

15) How do you handle delivery exceptions, and how are alerts triggered?

- Why it matters: exceptions are where failed deliveries and escalations multiply.

- Strong answer sounds like: defined exception types, alert rules, and intervention steps before failure.

- Red flag: they only act after a failed attempt.

- Follow-up: Who intervenes, how fast, and what actions can be taken?

- Section example answer: We provide a native integration, inventory updates within minutes, webhook events for key milestones, and customer-visible tracking with proactive delay alerts.

- Section red flag to watch: they cannot show what the customer actually sees.

Section 5, Pricing, transparency, and total cost

16) Can you provide a full rate card, plus examples priced for our typical orders?

- Why it matters: you cannot compare providers without pricing real baskets.

- Strong answer sounds like: full rate card plus 3 priced examples based on your real orders.

- Red flag: they will not share rates or examples in writing.

- Follow-up: Price these orders and show every line item.

17) What are the most common hidden fees, and when do they trigger?

- Why it matters: receiving rules, storage rules, relabels, account fees, and touches can double costs.

- Strong answer sounds like: a clear list of common fees and how to avoid them.

- Red flag: they claim no hidden fees but will not list triggers.

- Follow-up: What are the top 10 line items that surprise new clients in month one?

18) How do shipping rates work, and do we get multi-carrier optimisation or fixed carrier rules?

- Why it matters: cheap shipping that breaks service levels increases refunds and support cost.

- Strong answer sounds like: carrier options, rate logic, and guardrails for service levels.

- Red flag: opaque rates, forced carrier, no performance reporting.

- Follow-up: How do you handle carrier failures and route changes?

- Section example answer: Here is the full rate card and three priced orders including pick, pack, packaging, storage, shipping, and extra touches.

- Section red flag to watch: refusal to provide examples in writing.

Section 6, Performance, SLAs, and accountability

19) What SLAs do you commit to, including cut-off times, accuracy, on-time dispatch, and scan compliance?

- Why it matters: SLAs protect your customer promise and reduce support load.

- Strong answer sounds like: measurable targets, clear definitions, and reporting cadence.

- Red flag: vague commitments with no definitions.

- Follow-up: Show SLA definitions and last month’s SLA report.

20) What happens if SLAs are missed, and what remediation do you offer?

- Why it matters: without consequences, SLAs are marketing.

- Strong answer sounds like: credits or remediation steps plus root-cause analysis.

- Red flag: blame shifting with no accountability.

- Follow-up: Give three recent SLA miss examples and what you did.

21) How do you report performance monthly, and will you break down failure reasons?

- Why it matters: totals do not fix problems, reasons do.

- Strong answer sounds like: monthly review with breakdowns, plus actions and owners.

- Red flag: dashboard only, no root causes, no exports.

- Follow-up: Do we get raw data exports?

- Section example answer: Cut-off is 2pm, accuracy target is 99.5%, monthly report includes root causes and remediation.

- Section red flag to watch: no remediation process.

Section 7, Returns, compliance, and risk planning

22) What is your returns process, timelines, grading rules, and restock policy?

- Why it matters: slow returns delay refunds, hurt reviews, and lock up inventory cash.

- Strong answer sounds like: clear timelines and grading outcomes.

- Red flag: no defined timelines or inconsistent grading.

- Follow-up: What percent of returns are processed within 48 hours?

23) Do you offer a branded returns portal or automated labels and status updates?

- Why it matters: returns visibility reduces support load and keeps customers calm.

- Strong answer sounds like: self-serve returns, milestone statuses, automated updates.

- Red flag: email-only returns with no visibility.

- Follow-up: Show the customer statuses and message templates.

24) What security and compliance controls do you have, facility and data?

- Why it matters: theft and data exposure are real business risks.

- Strong answer sounds like: access controls, audit trails, written policies.

- Red flag: vague answers, nothing documented.

- Follow-up: What audits or certifications can you share?

25) What is your disaster plan, and what is the real fallback?

- Why it matters: one disruption can create backlog and a support crisis.

- Strong answer sounds like: documented plan, communication steps, realistic fallback.

- Red flag: it never happens, no plan.

- Follow-up: When was the last disruption, and what did you do?

- Section example answer: Returns are inspected within 48 hours, graded by rules, restocked or quarantined, and customers see status updates at each step.

- Section red flag to watch: no returns timelines and no returns visibility.

One-screen comparison scorecard

Use a 1 to 5 score for each category. Double-weight any category that is critical for your business.

| Category | Score 1–5 | Notes |

|---|---|---|

| Fit and experience | ||

| Services and workflows | ||

| Capacity and peak readiness | ||

| Tech and integrations | ||

| Tracking and exceptions | ||

| Pricing transparency | ||

| SLAs and accountability | ||

| Returns performance | ||

| Reporting and visibility | ||

| Risk and continuity | ||

If you only ask five questions, ask these

- Can you price 3 real orders using your full rate card, in writing, with all line items?

- What are your cut-off times and accuracy SLAs, and what happens when you miss them?

- What tracking milestones and ETA updates do customers see, and how are exceptions handled?

- What is your peak season plan, and how do you protect service when volume spikes?

- What is your returns timeline from received to graded to restocked, and what customer updates exist?